|

How does Cola Work? Let's assume you have a monthly benefit of $5,000. If you're unsure what the monthly benefit is, check out my other contribution in the Disability 101 series here.

Now let's say you become disabled and become eligible for disability benefits on your disability income policy. If it has some type of COLA, the monthly benefit will increase by x% annually. The intention is to keep up with inflation. This can be a powerful add-on to your policy at a relatively small cost, depending on your age and financial situation. But allow me to make an assertion that you'll pick up on as you see the illustrations below: COLA has more value the younger you are.

Let me show you 3 examples. All examples will assume the policy in question has a monthly benefit of $5,000, an age-65 benefit period and any COLA will assume a 3% rate of increase.

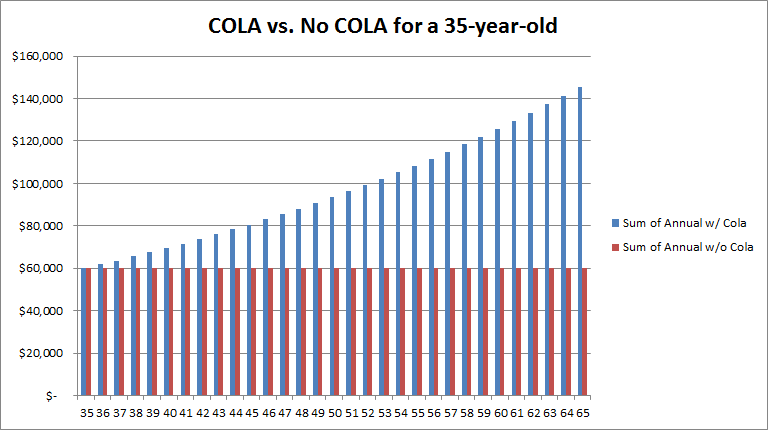

If a 35-year-old became permanently disabled, annual disability benefit would begin at $60,000 for the first year. Without COLA, it would remain $60,000 every year through age 65. The total benefit paid would be $1,860,000 ($5,000 x 12 x 31). With the COLA in place, the $60,000 of annual benefit would increase to $65,564 at age 38, then keep increasing 3% each year. It would be up to $88,112 at age 48, and 108,367 at age 55. The total benefit paid would be $3,000,161 ($60,000[1+.03]31). That's a $1,140,161 difference for the 35-year-old that is permanently disabled. FYI - COLA costs approximately $22/month for 30-year-old with a $5,000 monthly benefit.

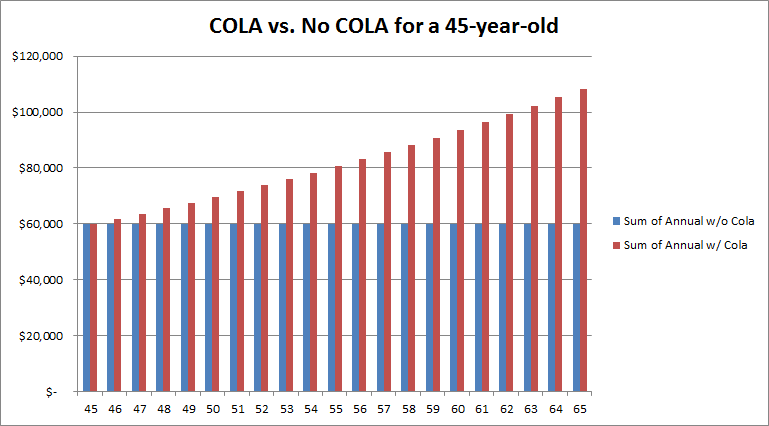

If a 45-year-old became permanently disabled, annual disability benefit would begin at $60,000 for the first year. Without COLA, it would remain $60,000 every year through age 65. The total benefit paid would be $1,260,000 ($5,000 x 12 x 31). With the COLA in place, the $60,000 of annual benefit would increase to $65,564 at age 48, then keep increasing each year. It would be up to $88,112 at age 58, and 108,367 at age 65. The total benefit paid would be $1,720,589 ($60,000[1+.03]21). That's a $460,589 difference for the 45-year-old that is permanently disabled.

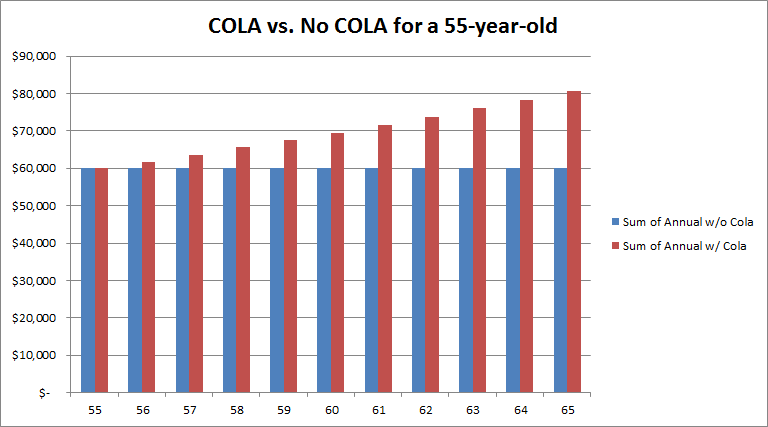

If a 55-year-old became permanently disabled, the annual disability benefit would begin at $60,000 for the first year. Without COLA, it would remain $60,000 every year through age 65. The total benefit paid would be $660,000 ($5,000 x 12 x 11). With the COLA in place, the $60,000 of annual benefit would increase to $69,556 at age 60, and increase to $80,635 at age 65. The total benefit paid would be $768,468 ($60,000[1+.03]11). That's a $108,468 difference for the 55-year-old that is permanently disabled. If you're only paying the $20/month for the COLA because you locked in premium rates as a 28-year-old, this may still be an advantageous feature to you. However, if you're applying for new coverage in your 50s, the cost of the COLA may outweigh the benefits.

|